Swipe fees recently made another public appearance in the news. Retailers have petitioned the high court to reconsider its March 2014 decision, which upheld debit card swipe fees at 21 cents per transaction as reasonable. This has been a hot topic for all retailers, with NACS being a large player representing the convenience store sector in this battle. Petroleum marketers want the limit lower than 21 cents for obvious reasons. Swipe fees—credit card and debit card—are reported as the second largest operating cost for petroleum marketers, just behind the cost of labor.1

Swipe fees recently made another public appearance in the news. Retailers have petitioned the high court to reconsider its March 2014 decision, which upheld debit card swipe fees at 21 cents per transaction as reasonable. This has been a hot topic for all retailers, with NACS being a large player representing the convenience store sector in this battle. Petroleum marketers want the limit lower than 21 cents for obvious reasons. Swipe fees—credit card and debit card—are reported as the second largest operating cost for petroleum marketers, just behind the cost of labor.1

The legal battle with swipe fees has been centered on the Dodd-Frank law passed in 2010 regarding debit card fees. The overall battle with swipe fees, however, encompasses more than just debit card swipe fees. Credit card fees were about 7 cents per gallon in 2011, averaging about 2% per transaction.1 PayPal has an even higher rate starting at 2.9% plus $0.30 per transaction.2

Margins on petroleum in this industry are already small, so any percentage “swiped” by credit card processors has a big impact to petroleum marketer operations. Mastercard and Visa have been named in the current swipe fee lawsuit, but they are by no means the only card processors in the gouging game. Nearly three quarters of all transactions made at the pump are made with plastic—think about how that equates in total swipe fees.3

Intevacon is a proprietary card processor but we offer more services to the petroleum marketer than the standard credit card company. More important to your bottom line, our pricing lets the petroleum marketer keep his/her margins. Convert one of your current Mastercard or Visa customers to a local house account and automate the process through Intevacon. We offer an online system that empowers the petroleum marketer with all of the controls needed to manage and grow his/her fleet accounts. We also provide the petroleum marketer an advantage to capture loyal fleet accounts by offering the option of online access to the cardholder. Intevacon succeeds when our customers succeed.

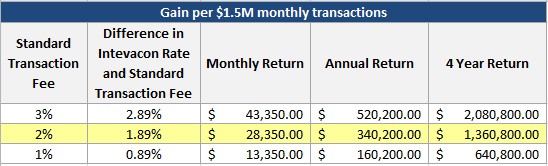

Converting cardholders who currently pay with a standard credit card or debit card to the Intevacon fleet card or prepaid card reaps huge savings every month. If a petroleum marketer converted $1.5 million of his current monthly business to the Intevacon fleet card, the savings from a standard credit card transaction fee of 2% would be approximately $340,200 a year or $1.36 million over four years. The higher the dollar volume on the Intevacon fleet card, the greater the savings from swipe fees. Supplement the fleet card with the prepaid card to get even higher returns and increase cash flow.

Swipe fees may be a necessary evil for a certain percentage of fueling customers, but there is a large cohort of cardholders who would benefit from the advantages of carrying a fleet card. Get to know your customer base and grow your business with Intevacon.

-

“Credit and Debit Card Fees.” NACS. Web. April 2014. http://www.nacsonline.com/Research/FactSheets/IndustryIssues/Pages/CreditCardFeesaGrowingChallengeforConvenienceStores.aspx

-

Paypal. Web. June 2014. https://www.paypal.com/webapps/mpp/paypal-fees

-

“2013 Retail Fuels Report.” NACS. 2013. Web. May 2014. http://www.nacsonline.com/YourBusiness/FuelsReports/GasPrices_2013/Documents/CFR2013_FullReport.pdf